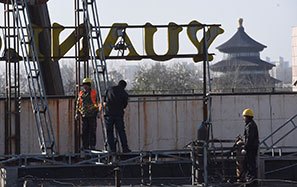

Preparations for IPO reform in full swing

Preparatory work on the long-anticipated registration-based system for initial public offerings is being carried out steadily, the capital market regulator said on Friday without disclosing further details.

The China Securities Regulatory Commission said it will issue a draft plan of the new IPO system and a set of related regulations to solicit public opinion after it gains the approval from the top legislature to implement the reform before completing the amendment of the Securities Law.

Sources close to the Standing Committee of the National People's Congress told China Daily that the legislature will deliberate and approve the IPO reform by the end of this month, clearing the last legal hurdle for the country to adopt the registration-based IPO system.

The approval from the top legislature will be valid for two years, meaning that the IPO reform must be completed and implemented within the time frame, Deng Ge, a CSRC spokesman, told a news conference in Beijing.

Unlike the current approval-based system where the regulator determines the timing and pricing of the IPOs, the new IPO system will emphasize information disclosure rather than corporate profitability and will let the market play a bigger role.

The acceleration of launching the registration-based IPO system underscored the government intention to address the pressing issue of high financing costs and fundraising difficulties for companies amid a slower economy, said Hong Hao, chief strategist at investment bank BOCOM International Holdings Co.

"The debt ratio of many Chinese companies has reached dangerously high levels and if the problem of financing difficulties is not addressed, it will affect the entire banking sector," he said.

While the new share sale reform could mean an expanded supply of IPOs which could depress market valuations, analysts said that the regulator will still administratively manage the IPO pipeline initially to avoid upsetting the market and creating sharp volatilities.

lixiang@chinadaily.com.cn