Shanghai Futures Exchange will hold a test run of its international trading platform on Tuesday, a step toward the establishment of China's crude oil futures contract later this year.

The platform involves trading in foreign currencies and renminbi, and is an indication of the exchange's efforts to promote the crude oil futures contract, said Li Li, senior analyst at Shanghai-based energy information consultancy ICIS C1 Energy.

Li said she was told of the test, and most analysts see it as a major step forward in the development of crude oil futures in China, a process that has been on the drawing board for several years.

Ji Xiangyu, an official at the China Securities Regulatory Commission, said, "We will support the launch of the crude oil futures contract in China."

He said it will discuss regulations on foreign investors' participation in the platform with domestic exchanges, especially with regard to legal issues.

Li said: "China's financial markets, including the futures exchange, are still in their infancy concerning internationalization. However, China is making active moves to push this forward."

The exchange aims to build a trading platform facing the global market. Thus, the key problem is how to attract major oil players to take part, she said.

According to C1 Energy, the exchange has already held several introductory meetings in London, New York, Singapore and Saudi Arabia to promote its contract.

As China's first crude oil futures contract, its cooperation with Saudi Arabia, the world's largest crude oil producer, is significant, said an industry analyst who declined to be named.

He said Saudi Arabia's participation in the development of China's crude oil futures, and its involvement in cost, insurance and freight oil pricing, would have a very positive impact.

Technology is not a problem for the platform, and its timetable depends on national regulations, he added.

"China will become the biggest crude oil buyer after the shale gas revolution in the United States. The influence of the exchange will be huge if it is in the world's biggest crude oil buyer and seller," he said.

In a bid to gain greater influence on international commodities prices, China's financial center Shanghai is making efforts to become a global commodities trading center in five to 10 years, Ai Baojun, the city's vice-mayor, said in November.

The establishment of the crude oil futures contract on the Shanghai Futures Exchange will help the country deal with fluctuating oil prices and increase its influence over global prices.

As the world's second-largest oil importer, China's oil imports have increased to about 60 percent of its consumption, said an industry official.

dujuan@chinadaily.com.cn

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

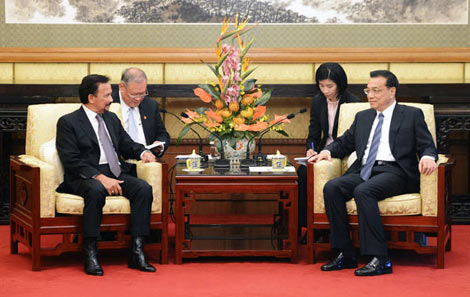

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show